There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Discover why holding equity investments for 5-7 years dramatically reduces risk of losses from 23% to nearly zero. Analysis of NIFTY 50 rolling returns over 20+ years reveals the optimal holding period for Indian equity investors.

Mon Sep 1, 2025

If you've ever felt disappointed seeing your portfolio in red after holding it for a year, you're not alone. But here's something that might surprise you: statistically, you had 25% chance of experiencing negative returns in the Indian equity market over any one-year period. The good news? Time can be your greatest ally in investing.

The Reality Check: One Year Isn't Always Enough

Looking at the NIFTY 50 Total Return Index (TRI) data spanning over two decades, we see a sobering truth: 23% of all one-year rolling periods resulted in negative returns. That means if you invested in the NIFTY 50 at any random point and held for exactly one year, you had nearly a quarter probability of losing money. The one-year returns have been wildly volatile, swinging from a spectacular gain of 110% to a crushing loss of -55%. With a standard deviation of 25.45%, one-year investments in Indian equities resemble a roller coaster more than a wealth-building journey.

The Magic Starts at Three Years

Here's where things get interesting. Extend your holding period to just three years, and the probability of negative returns drops dramatically to 6.62%. That's a massive improvement – you've cut your risk of losses by more than two-thirds simply by being patient. The volatility also calms down significantly. The standard deviation falls from 25.45% to 12.57%, meaning your investment journey becomes considerably smoother.

The Sweet Spot: 5-7 Years

At the five-year mark, something remarkable happens: negative returns virtually disappear. The data shows only 0.08% of five-year rolling periods resulted in losses. The minimum return improves to -1.03%, while you still maintain healthy average returns of 15.50%.

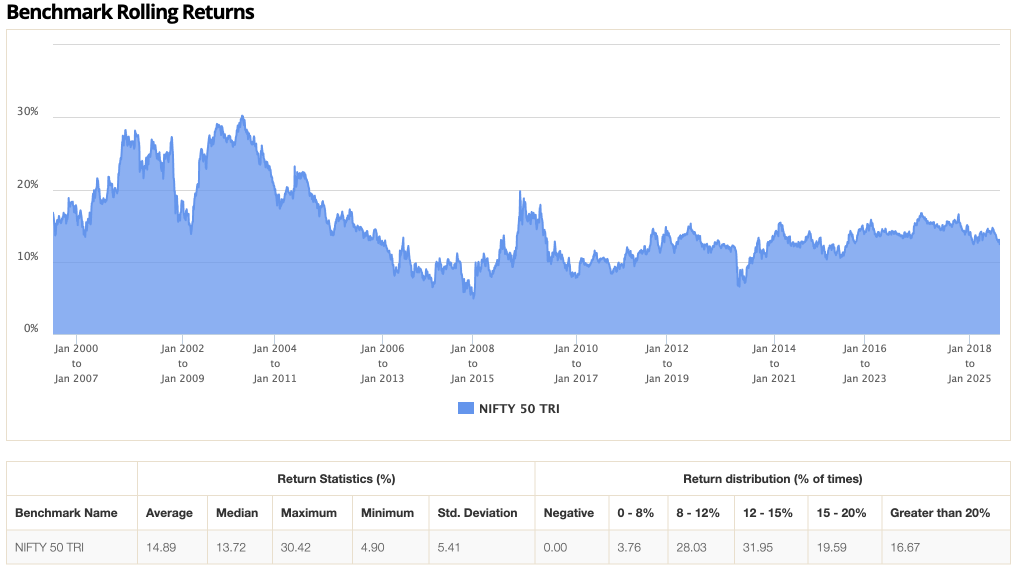

By seven years, the probability of negative returns drops to absolute zero in the historical data. Every single seven-year period in the NIFTY 50 TRI has delivered positive returns, with the minimum being 4.90%.

The Consistency Champion: 10+ Years

For those with a decade-long horizon, the Indian equity market has been remarkably consistent. Ten-year rolling returns show:

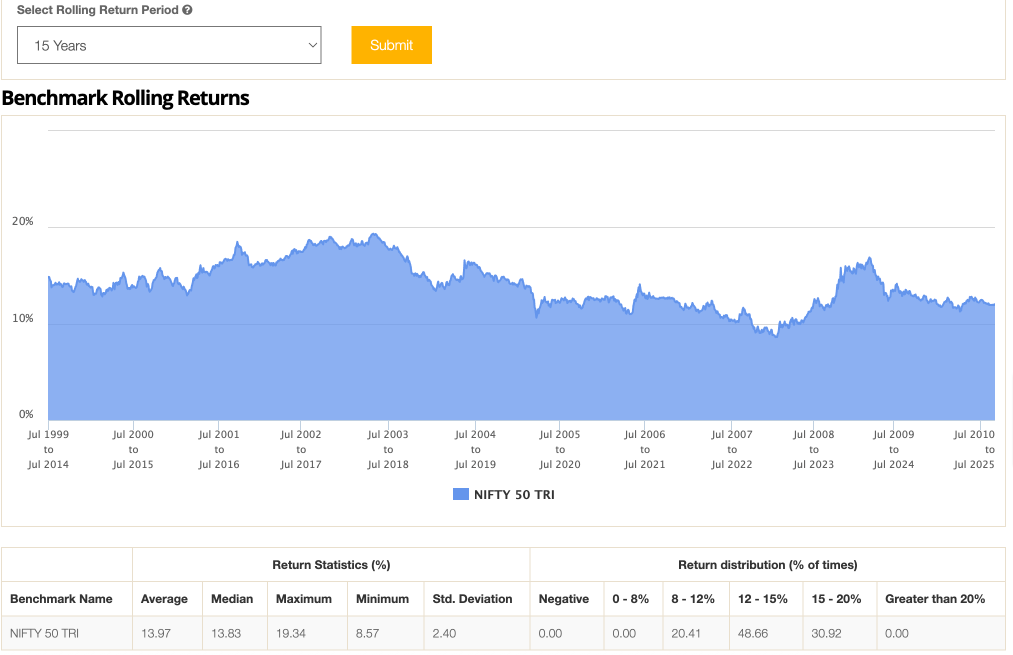

At 15 years, the consistency becomes even more pronounced, with returns ranging between 8.57% and 19.34%, and the median settling at a healthy 13.83%.

At 15 years, the consistency becomes even more pronounced, with returns ranging between 8.57% and 19.34%, and the median settling at a healthy 13.83%. Conclusion:

Conclusion:When you invest in equities for one year, you're essentially accepting a 1-in-4 chance of losses. But stretch that to five years, and your odds of success improve to better than 99%. Short-term volatility that creates those -55% drawdowns in one-year periods gets smoothed out over longer horizons. The data reveals an important truth: it's not about timing the market, but time in the market. Even investors who entered at peak valuations historically recovered and made money if they held for 5+ years.

The next time market volatility makes you nervous, remember this: every single 7+ year period in the NIFTY 50's history has rewarded patient investors with positive returns. In investing, patience isn't just a virtue – it's a strategy backed by decades of data.

Kirubakaran Rajendran

Full Time Algo Trader